Greg bright of top1000funds.com reports, New endowment model: follow the SWFs:

Greg bright of top1000funds.com reports, New endowment model: follow the SWFs:

Some sort of shape is starting to take place, post-global crisis, as to how the biggest, longest-term investors are spending their money. If the endowment model was the one to follow for the past 20 years, the sovereign wealth fund model may be the one to follow for the next.

Endowment-envy swept the world in the early part of this decade, which was probably a decade too late to reap the benefits from following the very clever investment strategies of the likes of Yale and Harvard. By the time of the global financial crisis, the envy had faded.But investors should think about why the endowment model of investing worked so well for as long as it did. If we can isolate the good things and then transport them to the post-crisis world, a new and better model may emerge. And, as always with investing, if the strategy is right, those in first will be rewarded.

What the big endowments did was invest directly, with their own teams of specialists and professionals, in areas where they had particular expertise, such as private equity and real estate. They then laid off the other parts of their portfolio in much the same way as big pension funds do anywhere, with a mix of growth and defensive allocations.

The problem was that in the crisis, correlations all went to one, and liquidity became a big issue. Endowments usually have to pay some income each year to their associated institution (such as a university), the same as a pension fund does with its retirees. But endowments don’t have a sponsor to top up the pot after one or two negative years. They have to rise and fall on their own merits.

Sovereign wealth funds are also a mixed bag of investors. Some of them have target dates for delivering on returns, some have target returns over various periods. Some are just set up to “make money” for the country by investing resources or foreign exchange reserve build-ups. Some are very transparent, others remain opaque.

What they have in common, though, is a single shareholder – a government – with a legislated genuine long-term aim for the fund’s investments.

Their investments, over the past 10-or-so years when the SWFs around the world have started to attract headlines, have also been a mixed bag. But a common element is the desire to take significantly large stakes in companies or other assets which reflect a long-term theme.

SWFs have, for instance, waded into hostile takeover battles for resource companies. They have invested directly in big infrastructure projects. And they have backed IPOs of established businesses which are targeting future growth areas.

This thematic focus has exacerbated political concerns about some SWFs being too nationalistic. Those from resource-importing countries taking big positions in resource exporters can be perceived as politically inspired. Or not.

But all investors can identify themes and direct their asset allocation accordingly. SWFs have the added advantages of fire-power to get a seat at any table and the inhouse resources to analyse and negotiate their positions.

A classic example of a thematic direct investment by a SWF from a resource-importing country, China, was written up last week in a client newsletter by HSBC, the global bank and fund manager.

In its case study, HSBC focused on a food stock which encompasses the two themes of globalisation and increasing demand for higher-protein food. The stock is Noble Group, based in Hong Kong and listed in Singapore. Last year, the China Investment Corporation, China’s $300 billion SWF, bought 15 per cent of Noble for $850 million.

Noble has operations in a lot of countries, vertically integrating its business and clipping the ticket at various points. It started life as a commodities trader but has grown into a supply chain manager of agricultural and energy products. One of its products is soya beans.

Soya beans, which have East Asian roots through history, are grown now mainly in South America and used for a range of products from animal feed and edible oils to soaps and biodiesel fuel.

Noble sells fertilisers to the South American soya bean farmers, buys the grain from them, stores it in Brazil and Argentina, crushes it, ships via its Noble Chartering subsidiary around the world – including China, which takes 37 per cent of the output – and sells to wholesalers.

Ricardo Leiman, Noble’s Brazilian-born chief executive, was quoted in the HSBC newsletter as saying that Noble and CIC will continue to look together for investment opportunities.

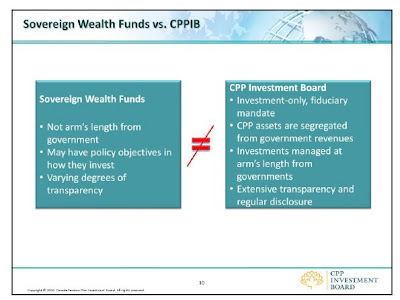

The biggest advantage SWFs have is deep pockets, which allows them to ride out any crisis in the short-term. The biggest problem they have is governance -- too much political interference in their operations and too little transparency. The slide below was taken from a speech David Denison, President & CEO of the Canada Pension Plan Investment Board (CPPIB), made back in June, Fixing the Future: How Canada Reformed Its National Pension Plan.

Despite these shortcomings, SWFs are a power to be reckoned with. They provide huge liquidity to all sorts of markets, both public and private. Mr. Bright wrote another interesting article in early October, GIC signals five emerging markets for future growth:

The Government of Singapore Investment Corporation (GIC) has signalled a further shift towards selected emerging markets and to private markets, in its annual report published last week.

GIC has highlighted five emerging markets in particular for medium-term growth: China, India, Brazil, South Korea and Taiwan.

But Ng Kok Song (pictured), GIC’s chief investment officer, was quoted after a press briefing on the annual report, as saying the sovereign wealth fund would favour private markets over listed equities for its increased emerging markets exposure.

At the end of its March fiscal year, the broad asset allocation for GIC, which invests the country’s foreign exchange reserves, was: 51 per cent listed equities, 20 per cent bonds and 25 per cent alternatives. Geographically, investments were spread: 36 per cent in the US, 30 per cent in Europe and 24 per cent Asia.

Ng said that about 80 per cent of GIC’s emerging markets exposure would be accounted for the three BRICs (excluding Russia) and Korea and Taiwan.

He said the fund would not necessarily be taking the well-trodden path of public markets for its exposures, but rather look at real estate, private equity and infrastructure.

GIC reported a total investment return of 7.1 per cent for the year, against 5.7 per cent the previous year.

The fund, established in 1981, has a 20-year investment horizon mandated by the Singapore Government. It tends to invest more widely than the other Singapore sovereign fund, Temasek Holdings, which has concentrated more on the Asian region.

Tony Tan, GIC’s deputy chairman, said: “GIC started to selectively take on more risk from the second quarter of 2009, amidst growing confidence in the economic recovery. I am pleased that the 20-year return of the portfolio has improved.”

I wonder how many more SWFs "started to selectively take on more risk from the second quarter of 2009". If this is the case, then expect a flurry of activity in private and public markets as the economic recovery takes hold. To ignore these deep pockets of liquidity is foolish.

Finally, Amanda White of top1000funds.com reported in late September, Conservative overweighting hinders world’s largest investor:

An overweight allocation to domestic bonds has not helped the world’s largest investor in the June quarter, with a massive $42 billion shaved off the assets of the ¥116,802 billion ($1.37 trillion), Government Pension Investment Fund of Japan (GPIF).

The fund’s ¥10 trillion exposure to international equities was the main contributor to the negative performance, with that asset class returning -17.43 per cent. Domestic stocks, also underperformed with a -13.93 per cent return for the quarter.

The GPIF has a 72 per cent allocation to domestic bonds, up slightly from the year before, and above its target position of 67 per cent. It also has another 8 per cent in international bonds.

The fund has allocations of 10.87 per cent in domestic equities and 9.11 per cent in international equities, and is most underweight in short-term assets, where its target is 5 per cent, and its allocation is short of 1 per cent.

Last financial year, ending March 31, international equities were the main positive contributor to performance, with a massive 46.11 per cent. The total fund return for the year was 7.9 per cent

Most of the assets are managed passively, and last financial year (ending March 31, it reduced its weighting to actively managed international equities, widening the number of service providers at the same time.

Overall the fund employs more than 80 funds managers.

I get nervous when I see funds massively overweight domestic or international bonds. I reread Niels Jensen's excellent comment, Insolvency Too, and paid particular attention to this passage:

Entire countries may have to (read: will) default on their pension obligations either overtly or covertly. A few countries have already started to adapt to the new reality by delaying the retirement age by a year or two; however, in order to solve a problem of this magnitude, we need a work force that is prepared to work until the age of 75. Expect some hard fought battles in the streets of Paris, Madrid and Athens!

The casino solution Interestingly, there is a solution. Solvency II does not require for insurance companies to hold any capital against EEA5 government bonds. As pointed out by Deutsche Bank in a recent research paper6, this looks an extraordinarily brave decision by the regulator, considering recent developments in peripheral Europe. But rules are rules. If you can see your pension fund sinking like the Titanic, but you know you have a good shot at saving the ship, if only you fill up the portfolio with high yielding government bonds, it must be very tempting to stuff your portfolio with Greek (10-year currently yielding 10.7%), Irish (6.6%), Portuguese (6.4%) and Spanish (4.1%) government bonds. It is one heck of a gamble but, then again, desperate people do desperate things.

At least one Spanish pension fund is already into this game. The €64 billion state pension fund, Fondo de Reserva, recently revealed that they expect to have 90% of their assets tied up in Spanish government bonds by the end of this year, up from about 50% in 2007. Expect this sort of behaviour to spread. It is a gamble many pension providers will be prepared to take, as the alternative is not that exhilarating either. Let’s just hope for the sake of millions of Spanish workers that the pension fund knows what it is doing. Unfortunately, Murphy’s Law has an unpleasant habit of popping up at the most inconvenient of times.

I seriously question why any pension fund would shift 90% of its assets to domestic government bonds. It's beyond stupid, it's actually criminal and violates basic principles of fiduciary duty. When the biggest bond bubble in history pops, these funds are going to get slaughtered. And amazingly, they think they're reducing risk. They're in for a nasty surprise!

5:33 PM

5:33 PM

febry

febry

0 comments:

Post a Comment